How and Why to Calculate Your Home Equity

Table of Content

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more. HELOCs typically function as interest-only loans during the draw phase, which is usually 5-10 years.

So, whether you’re trying to qualify for a home loan or an auto loan, make sure you even qualify. Just bear in mind that this loan prequalification calculator is in no way a guarantee. It is, however, a good starting point in figuring out if you can get pre-approval for a home loan. Very few lenders will let you borrow against the full amount of your home equity.

What Are Real Estate Construction Loans

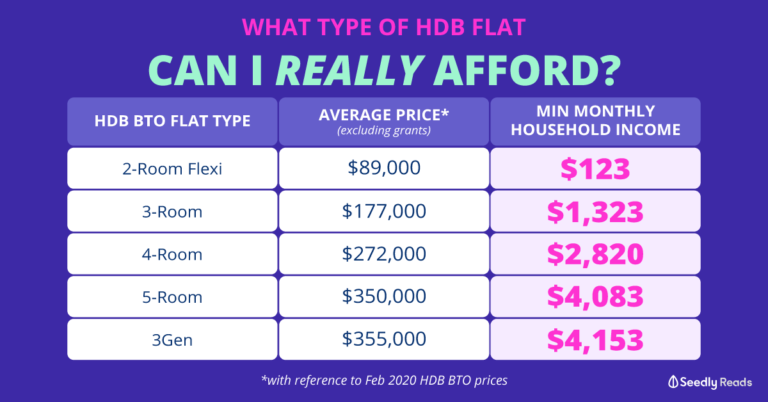

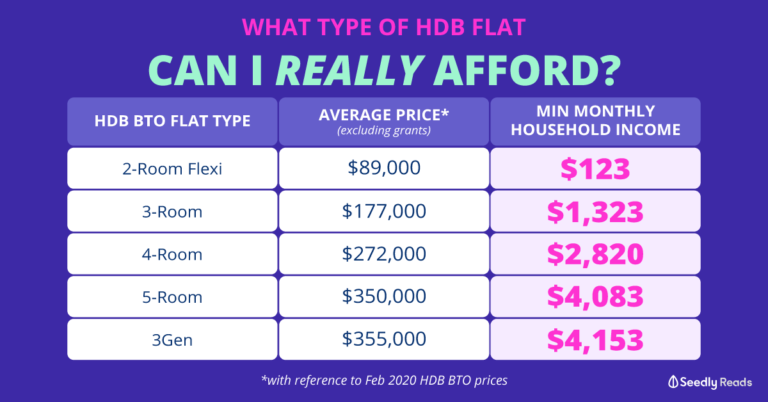

If you’re refinancing your mortgage while you’re in the middle of an exiting mortgage term, you’re likely to be hit with a prepayment penalty – more on that below. If you are purchasing a HDB flat, banks also have to calculate your Mortgage Servicing Ratio . MSR is capped at 30% of all borrowers’ gross monthly income. Calculation of MSR is based on loan amount and combined monthly gross income. Before determining if it is a good idea to take equity out of your house, it is important to first understand the risks involved.

Your lender has less risk because they can seize the asset if you don’t pay. This represents what you believe your current home is worth. Recent sales of comparable properties in your immediate area would be a good guide in this estimation. Unfortunately, you may not have enough home equity to get cash from your home. Search Discover When autocomplete results are available use up and down arrows to review and enter to select.

How Hard Is It to Get A Home Equity Loan?

In other words, you would make 26 half payments rather than 12. If you choose this option, make sure your lender will accept bi-weekly payments instead of monthly payments. A typical fixed-rate mortgage comes with 30-, 30-, or 15-year terms. However, there are some circumstances where a HELOC may not be the best option.

When buying a second home, you could use some or all of the available equity in your current property as a deposit for your new loan. A reverse mortgage is a type of loan that allows seniors to borrow against the value of their homes. The loan does not have to be repaid until the borrower moves, sells, or dies.

How Much Can You Borrow With a Home Equity Loan?

Government fees, Lenders Mortgage Insurance , council rates and utilities all add up. That’s on top of upfront costs such as conveyancing fees, property inspections and removal costs. Affordability calculator Calculate the price of a home you can afford.Loading... Rent or buy calculator Estimate when it makes sense to buy or rent.Loading... Refinance calculator Decide if mortgage refinancing is right for you.Loading...

To use it, enter the estimated value of your home, the amount owed on your mortgage and any second liens, and the maximum loan-to-value ratio allowed by your lender in the boxes indicated. The line of credit available to you will be displayed in the blue box at the top. To calculate home equity percentage, first get the equity by subtracting the amount currently owed in mortgage loans from the current appraisal value of the home. The percentage value is then arrived at by expressing this equity as a percentage of the appraisal a value of the home. A home equity loan calculator is a good way to start exploring price options for tapping the equity in your home. You can use this calculator to get an idea of whether you can qualify for a home equity loan, how much money you might qualify for and what it may cost you.

It may then be worth less than what you owe on your mortgage. This will make it more difficult to get approved for a better loan, potentially putting you in a difficult situation. PMI is required as long as your LTV ratio is above a specified level. To simply get an idea of how much your home is worth, you can use an online estimator.

Every bank does things differently but I'm just gonna give you kind of an idea of how a bank might go about calculating the maximum you could get for a home equity loan. When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget. When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area. The lower the DTI, the more likely a home-buyer is to get a good deal.

1 Comparison rates are based on a secured loan of $150,000 over a term of 25 years. Choose repayment methods or offset account to find out how much interest and time you could save on your home loan. These loans are secured by your home but are separate from your primary mortgage. Generally, lenders require a credit score of at least 620 for a HELOC. Select a higher score to see how growing your credit affects your ability to qualify. Put simply, equity is the difference between the amount you owe on your home loan and the current value of your property.

You probably won’t qualify for a HELOC if you owe more than 85% of your home’s value. Over the long haul, home prices generally rise, but they can take big dips, too. Plug in a lower home value to see its effect on your borrowing capability. If you have at least 15% equity in your home, you may be able to qualify for a home equity line of credit.

One is what your lender thinks you will be able to afford—which is calculated by your gross income, front-end ratio, back-end ratio, and credit score. Another factor is what type of house you want to live in, for how long, and what types of consumption you are willing to give up to afford it. This is the amount you borrowed from the bank or lender, which is essentially the purchase price minus the down payment. Usually, the largest loan you can borrow will correlate with your affordability, i.e., household income. This equation is the simplest calculation that uses only your timeline, interest rate, and loan amount. It is common, however, to incorporate variables such as homeowner’s insurance, property tax, and/or a down payment.

Use your lender’s maximum CLTV percentage and multiply that by your current home’s value to calculate maximum loan amount. When you subtract your existing mortgage balance from that maximum loan amount, you will see exactly how much cash can be obtained through cash-out refinance. If you have the cash available, pay down a large portion of your principal at once. Depending on the lender, you also may be able to recast your mortgage by keeping your original payoff date and lowering your monthly payments. On the other hand, a home equity loan is a lump sum loan with a fixed interest rate and fixed monthly payments. You borrow a set amount of money and pay it back over the life of the loan.

Twenty percent is a common percentage that lenders want the borrower to make as a down payment. For down payments under 20%, the borrower is required to pay private mortgage insurance, or PMI. Usually, the more money you spend on the down payment, the better your interest rate will be—and the more likely you will get approved. Depending on what you need the money for, and how much you need, a HELOC may or may not be a great option for you. It's generally a better idea than borrowing with a credit card, as the low HELOC interest rates offered by lenders could easily mean thousands in savings.

Comments

Post a Comment